All Concerning Investing Off Coast: Advantages and Methods for Success

Offshore investing has come to be an appealing alternative for numerous people looking for to enhance their financial profiles. It offers distinct benefits such as property protection and accessibility to global markets. Guiding with this facility landscape requires careful factor to consider of various factors. Understanding the prospective advantages and reliable techniques is crucial for success. As investors weigh their choices, they need to additionally be mindful of the obstacles that exist in advance. What actions can they take to ensure their investments grow?

Comprehending Offshore Spending: What It Is and Exactly how It Functions

While lots of people seek to diversify their portfolios, understanding offshore investing is fundamental for making notified choices. Offshore investing includes placing economic properties in nations outside one's home territory, commonly to obtain access to various markets, tax obligation advantages, or regulatory benefits. This method can consist of a range of financial tools such as supplies, bonds, real estate, or mutual funds.Investors usually turn to overseas accounts to secure their riches from economic instability or negative local guidelines. By understanding the legal and tax obligation effects of offshore investing, people can browse this facility landscape better. Expertise of various offshore jurisdictions, each with one-of-a-kind regulations and financial investment chances, is essential.While offshore investing can offer potential advantages, it is very important for people to perform thorough research study and talk to monetary experts to assure conformity with global regulations and policies, thereby protecting their investments and enhancing their monetary methods.

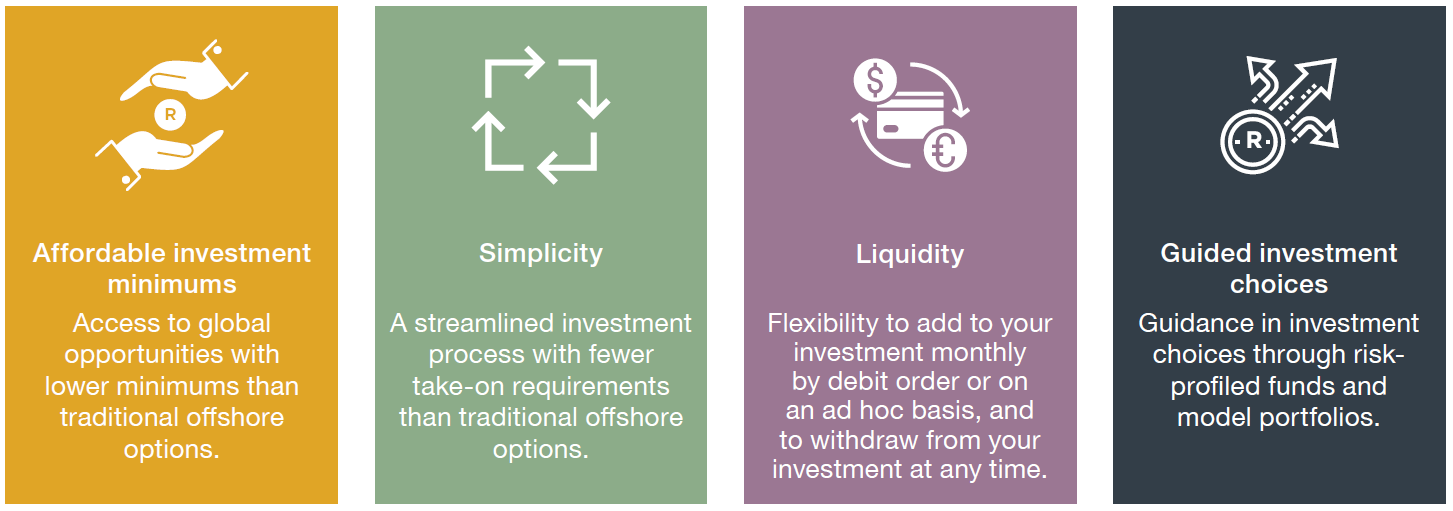

Key Benefits of Offshore Investments

Offshore investments offer a number of vital benefits that can boost an investor's monetary portfolio. One substantial benefit is property protection. By holding investments in foreign jurisdictions, people can protect their assets from potential lawful problems or financial instability in their home country. Additionally, offshore investments commonly provide access to varied markets and investment opportunities that might not be offered domestically, permitting far better threat management and capacity higher returns.Tax benefits also play an essential duty; many overseas jurisdictions provide desirable tax obligation programs, allowing capitalists to optimize their tax obligation obligations. Furthermore, privacy and personal privacy are usually enhanced, as lots of offshore locations have stringent legislations protecting financier identities. Offshore financial investments can offer as a bush against currency changes and geopolitical risks, giving a layer of security in a progressively volatile global economic climate. To conclude, these key advantages make offshore investments an appealing alternative for savvy capitalists seeking to diversify and secure their wealth.

Popular Offshore Financial Investment Cars

When taking into consideration overseas financial investments, people often transform to mutual funds abroad and offshore actual estate as prominent automobiles. These choices supply unique advantages, such as diversity and potential tax obligation advantages. Recognizing the dangers and qualities related to each can assist capitalists make educated choices.

Shared Funds Abroad

What makes common funds abroad an attractive option for investors seeking diversification? These investment cars use exposure to international markets, permitting capitalists to maximize growth chances not offered in their home countries. By merging resources from different investors, shared funds abroad make it possible for individuals to access a diversified profile of possessions, therefore reducing threat. Additionally, they frequently provide expert management, where seasoned fund managers make notified choices based on market patterns and research. This can be especially valuable for financiers not familiar with international investments. Lots of overseas mutual funds come with favorable tax treatment, enhancing total returns. In general, shared funds abroad stand for a strategic alternative for financiers seeking to widen their investment horizons while keeping a degree of benefit and accessibility.

Offshore Property

Financiers looking for to expand their profiles beyond standard assets may discover overseas real estate to be an eye-catching option - Investing Off Shore. This investment vehicle enables people to expand their holdings throughout worldwide markets, frequently in territories with beneficial tax obligation laws. Properties in emerging markets can supply substantial appreciation possibility, while established places offer stability and rental revenue. Furthermore, offshore realty can offer as a bush against regional economic recessions, supplying a barrier through worldwide diversity. Capitalists ought to perform extensive due diligence, considering elements such as local laws, market trends, and building administration choices. By leveraging skilled suggestions and research, financiers can purposefully position themselves to profit from the benefits of offshore realty investments

Approaches for Effective Offshore Spending

Although passing through the complexities of offshore investing can be intimidating, employing efficient techniques can substantially enhance prospective returns while mitigating threats. One important technique includes extensive research study and due diligence, which consists of recognizing the lawful frameworks, tax implications, and economic conditions of the target jurisdiction. Diversification throughout possession classes and geographical regions is an additional essential method, as it aids spread out risk and profit from diverse market opportunities.Additionally, leveraging local proficiency by working together with reputable monetary experts or investment company can supply valuable understandings and advice. Investors should additionally consider using tax-efficient frameworks, such as offshore depends on or companies, to optimize their economic results. Keeping a lasting perspective is critical; offshore investments may experience volatility, however persistence can lead to significant incentives. By implementing these approaches, investors can navigate the offshore landscape more successfully and function in the direction of accomplishing their economic goals.

Common Risks to Stay Clear Of in Offshore Investments

While the appeal of offshore financial investments can be strong, numerous usual risks can undermine potential success. One significant danger is insufficient research; investors may rush into possibilities without totally comprehending the marketplace, causing bad choices. Furthermore, ignoring the significance of diversification can cause too much exposure to a solitary property or region, increasing susceptability to market fluctuations.Another frequent blunder includes neglecting the linked expenses, such as monitoring costs or tax obligation implications, which can wear anonymous down returns. Investors usually underestimate the complexities of currency threat as well, where undesirable currency exchange rate activities can impact earnings. An absence of a clear investment strategy can lead to impulsive choices driven by market patterns instead than audio evaluation. By acknowledging and staying clear of these mistakes, investors can improve their chances of attaining successful overseas investments while protecting their resources.

Lawful Factors To Consider and Compliance in Offshore Spending

Understanding the lawful landscape is crucial for anybody considering overseas financial investments. Capitalists have to navigate intricate international regulations, tax obligation regulations, and conformity requirements that vary considerably across jurisdictions. Each country has its own regulations pertaining to foreign investments, and stopping working to stick to these regulations can result in serious penalties, consisting of penalties or criminal charges.Additionally, investors need to recognize the implications of tax obligation treaties and reporting commitments, such as the Foreign Account Tax Conformity Act (FATCA) in the USA. It mandates that international banks report details concerning accounts held by U (Investing Off Shore).S. citizens.Due persistance is critical; dealing with monetary and legal consultants experienced in offshore investing can help ensure conformity with all relevant regulations. By comprehending these lawful considerations, investors can protect their possessions and take full advantage of the benefits of offshore financial investments without facing unneeded lawful challenges

Often Asked Concerns

Just how Do I Pick the Right Offshore Financial Investment Area?

Picking the ideal offshore investment place involves reviewing factors such as tax obligation regulations, political security, financial atmosphere, available investment possibilities, and legal demands. Detailed research study and specialist suggestions are essential for educated decision-making in this intricate procedure.

What Are the Tax Obligation Ramifications of Offshore Investments?

Can I Invest Offshore Without a Foreign Savings Account?

Spending offshore without an international savings account is possible via various platforms and solutions, such as online brokers or mutual fund. These options enable individuals to accessibility global markets without needing a local financial relationship.

How Do Money Fluctuations Effect Offshore Investments?

Money fluctuations can substantially affect overseas investments by changing the value of returns when transformed back to the capitalist's home currency. This can either enhance earnings or aggravate losses, depending upon market problems and timing.

What Is the Minimum Financial Investment Required for Offshore Opportunities?

The minimal financial investment needed for offshore possibilities varies widely, commonly ranging from a couple of thousand bucks to millions. Variables influencing this include the kind of financial investment, jurisdiction, and specific economic institution requirements in concern. Offshore investments use several essential benefits that can enhance a capitalist's monetary portfolio. Additionally, offshore investments commonly offer access to varied markets and financial investment possibilities that might not be readily available domestically, enabling for far better risk management and potential greater returns.Tax advantages likewise play a necessary function; many overseas jurisdictions supply desirable tax obligation routines, making it possible for investors to maximize visit this site their tax obligation liabilities. When thinking about offshore investments, individuals usually turn to mutual funds abroad and offshore actual estate as prominent automobiles. Selecting the best overseas investment location includes examining factors such as tax obligation laws, political stability, financial atmosphere, available financial investment chances, and legal demands. Currency changes can significantly impact offshore investments by altering the worth of returns when transformed back to the financier's home currency.